|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Equity Loan vs Other Financing Options: What You Need to KnowWhen considering tapping into your home's value, it's crucial to understand the different financing options available. This article will explore how home equity loans compare to other choices, such as personal loans and refinancing, helping you make an informed decision. Understanding Home Equity LoansHome equity loans allow homeowners to borrow against the equity built up in their homes. They offer a fixed interest rate, which can be beneficial for budgeting.

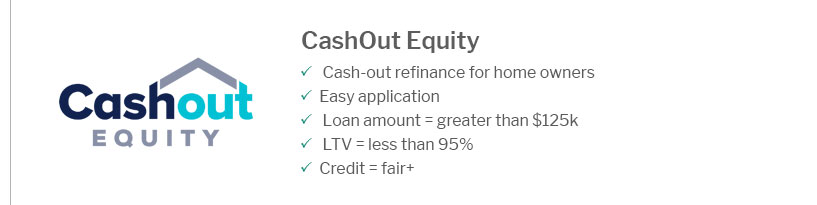

Home Equity Loan vs Personal LoanChoosing between a home equity loan and a personal loan depends on various factors, including interest rates, loan amounts, and repayment terms. Interest RatesHome equity loans typically have lower interest rates than personal loans because they are secured against your home. Loan AmountWith a home equity loan, you might access a larger sum compared to a personal loan, which can be crucial for significant financial needs. Home Equity Loan vs RefinancingRefinancing is another way to leverage your home's value. It involves replacing your current mortgage with a new one, potentially at a lower interest rate.

To evaluate your options, you can use tools like a condo refinance calculator to see potential savings and costs. Choosing the Right OptionYour choice will depend on your financial goals, current interest rates, and how much equity you've built up. Consulting with top mortgage lenders us can provide personalized advice based on your situation. FAQ

https://www.bankrate.com/loans/personal-loans/personal-loans-vs-home-equity-loans/

Personal loans and home equity loans can be used for making home improvements, consolidating debt, paying for medical expenses and many other purposes. https://www.bankofamerica.com/mortgage/learn/home-equity-loan-vs-line-of-credit/

What is a home equity line of credit? A HELOC provides ongoing access to funds. Unlike a conventional loan a HELOC is a revolving line of credit, allowing you ... https://www.investopedia.com/mortgage/heloc/home-equity-vs-heloc/

Home Equity Loans vs. HELOCs: What's the Difference? A home equity loan gives you a lump sum to pay back over a set period with fixed payments, while a HELOC ...

|

|---|